Company Incorporation

Get Your Company Registration

Register Your Business with ease.

Free Consultation

Today's Offer

Company Incorporation

Direct Call: Mumbai : 9167687835

Direct Call: Pune : 9028055500

What Is Company Registration/ Incorporation?

Overview

Company registration means legally having the right to do business. In India, registration of a company is also called as the company incorporation or the formation of business. The corporation can be a company, any start-up, a non-profit organization, a micro small or medium scale business.

A company is a distinct legal entity that is separate from its shareholders. It is an essential feature of the company that there is a distinction between people who have control over the company’s affairs and the people who actually own it.

The Company Registration process in India is entirely online and is controlled and managed by the Ministry of Corporate Affairs (MCA) as per the Companies Act, 2013, and handled by the Registrar of Companies from the Central Registration Centre (CRC).

The company registration process is fully online. A Certificate of Incorporation with TAN and PAN can receive post-approval of the company registration process. With the Certificate of Incorporation, you can officially open a current bank account and commence your company activities.

For start-ups and big companies, private Limited Company is the most suitable option because its investors prefer the option of company registration.

Types of Companies

The types of companies that can be primarily registered in India, and each of which has its own unique features are

- Private Limited Company

- Partnership Company Registration

- Public Limited Company

- Sole Proprietorship

- Nidhi Company

- OPC Registration (One person company)

- LLP (Limited Liability Partnership)

- Section 8 Company

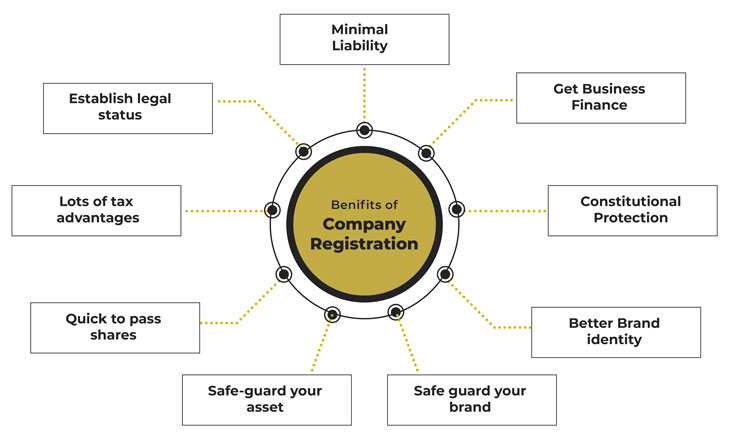

Benefits Of Company Registration/Incorporation

- Legal Identity/Recognition to the business

- Get investment/ funding for your business.

- Various Tax Benefits

- Enhanced Brand Image and Improved Trust Factor

- Your Liability as an individual is limited.

Company Registration Process

-

Name approval

The first step of integrating the company is to decide your company name, which will be applied to MCA for approval. Ideally, names given for approval should be unique and relevant to the business activities of the company.

-

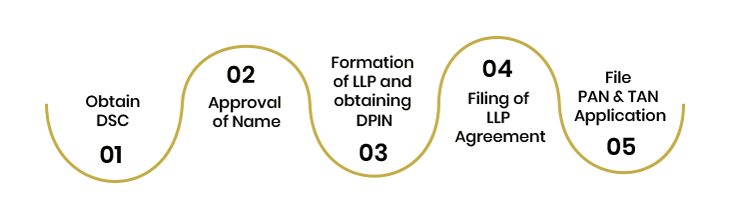

Application of DSC & DPIN

The next step for Company registration is to apply for a digital signature and DPIN. DPIN is the Director's identification number issued by Registrar, and the digital signature is an online signature that is used to sign the e-forms.

-

MOA & AOA submission

Once the name is approved, the Memorandum of Association and Articles of Association requires to be prepared, which contains the company's rules & by-laws that control the operation of the business. Both MOA and AOA are registered with the MCA with the subscription statement for the authentication & approval.

-

Prepare form & documents

Fill the application forms properly, attach the documents, have the same verified by a professional, then submit the form to ROC, and then make the payment.

-

Get incorporation certificate

Once all the documentation is completed & form is submitted with the department, the registrar issues the certificate of incorporation. The certificate of incorporation specifies important details about the company, such as CIN number, company name, date of incorporation, etc.

-

Apply for Bank account

After receiving the incorporation certificate, you can submit a copy of the incorporation certificate, AOA, MOA, and PAN along with the bank’s account opening form to open your bank account.

Checklist for Registering any Company in India

According to the regulations in the Company Act, 2003, for any company to be registered in India, at the time of registration, you must know some important details of the company are :

-

Company Name

Before company registration, it is necessary to get the approval of the company name from the concerned authority. The name of your business must be different. The proposed name should not match with any existing companies or trademarks in India.

-

Directors

At least 2 individuals out of which one must be an Indian resident. All directors are expected to have KYC documents. The maximum number of shareholders is 200, and the company can have up to 15 directors.

-

Shareholders

At least 2 shareholders must be there. It is likely to have individuals and entities as shareholders.

-

Minimum Capital Contribution

There is no minimum capital amount required for a company. A company should have a sanctioned capital of a minimum of Rs. 1 lakh. Anytime after the incorporation, the amount can also be increased.

-

Registered Office

Every company must have a local business address. So, in the future, a concerned person can contact the company through it. A company’s registered office does not need to be a commercial space. Even a rented home can be the registered office, as long as a NOC is received from the landlord.

-

Apply for Bank account

After receiving the incorporation certificate, you can submit a copy of the incorporation certificate, AOA, MOA, and PAN along with the bank’s account opening form to open your bank account.

Documents Required For Company Registration

- Copy of director's PAN Card.

- 2 Passport size photograph of directors

- Copy of address proof - rent agreement or property papers

- ID proof- Aadhaar Card or Voter identity card of directors

- Landlord NOC

- Electricity or Water bill of company place

Other Documents required for the registration process of the company

- A formal letter from ROC (for company name accessibility)

- DSC

- DIN

- Form-1 (company incorporation)

- Form-18 (company address)

- Form-32 (Details about directors, secretaries, and managers)

Frequently Asked Questions ?

As per the Companies Act, 1956, a Company is a group of people that is established and registered under this Act or any company’s previous laws. A company is a distinct legal entity that is separate from its shareholders. It is an essential feature of the company that there is a difference between people who have control over the company’s affairs and the people who actually own it.

Different types of companies that you can register in India are:

- Limited Liability Partnership (LLP)

- One Person Company (OPC)

- Public Limited Company

- Private Limited Company

- Non-Profit Organizations (Sec. 25 Companies)

Under the GST Act & Regulation, GST registration is mandatory if your total annual PAN based turnover exceeds INR 20,00,000 (Rupees Twenty Lakhs).

The idea of One Person Company is the new means of doing business introduced by the Companies Act, 2013. The old Companies Act, 1956, required a minimum of two directors and shareholders to create a private limited company. There is only one person in OPC who will act in the place of a Director and a shareholder as well. Such type of company is established as a Private Limited Company.A Private Limited Company has at least two members and two Directors, and the maximum number of members that it can have is 50. The total capital of such a company is made with shares, and every shareholder is a partner. A Pvt Limited Company’s directors should meet often, and all its transactions should be reviewed. This type of company name ends with the words Private Limited.

A Limited Liability Company is regulated by the Limited Liability Partnership Act, 2008. It is a corporate arrangement that encapsulates the versatility of a partnership and advantages of limited liability to the owners at a minimal cost. In certain words, it's a combination of a Company and Partnership where one partner is not responsible for the misconduct or carelessness of another partner.