Section 8 CompanyRegistration

Apply Online for Section 8 Company Registration

Quick, Convenient and Secure Online Process.

Free Consultation

Today's Offer

Section 8 Company Registration

Direct Call: Mumbai : 9167687835

Direct Call: Pune : 9028055500

Section 8 Company Registration

Overview

A Section 8 company as per the Companies Act, 2013, is an organization registered with the purpose of development of arts, sports, science, education research, religion, social welfare, protection of the environment, charity, or any other such thing. These are the limited companies set up under the Companies Act. As per the Section 8 Companies Act, the Government offered these companies an exclusive license.

Section 8 Company has more benefits than trust and society. Its registration is regulated by the Ministry of Corporate Affairs, whereas the Trust & Society registration is managed by the registrar of state under the State Government.

For Section 8 Company, it is not necessary to use the words ‘LTD’ or ‘PVT LTD’ in their name. With effect from June 5, 2015, under the act, there is no such provision with respect to the minimum capital.

Types of Non-Profit Organizations India

In India, the types of non-profit organizations, i.e., Section 8 Companies (earlier Section 25), are as follows:

- Societies enrolled under section 20 of the Societies Registration Act 1860.

- Trusts established under the Indian Trusts Act 1882

Donations/Funding of a Section 8 Company

Section 8 Company is not restricted to increase capital by way of deposits. However, they can take donations from the general public. Some of the ways by which it can increase funding are:

-

Foreign Donations

Foreign donations are permitted only when FCRA (Foreign Contribution Regulation Act 1976) registration has been taken. FCRA license can only be practiced after 3-years from the date of registration. However, if some urgent foreign donations are required, then you can ask for permission from the commissioner.

-

Equity Funding

Section 8 Company can also increase funds by issuing new equity shares at a higher rate.

-

Domestic donations

There is no restriction on domestic donations. But to prevent money laundering cases, a proper system must be laid down to keep them in control.

Advantages of Sec 8 Company in India

Benefits of registering a Section 8 Company are:

-

Section 8 Company Tax benefits

As it is a non-profit organization; therefore, they are excluded from some provisions of the income tax. They are also given various other exemptions and other tax benefits.

They obtain profits under section 80G of the Income Tax Act, 1961. Also, they pay less stamp duty than other organizations.

-

No Requirement of Title

They do not use the terms “private limited” or “limited” as a suffix in the company name.

-

Ease in Transferring Ownership

Unlike other companies, where it is not possible to transfer ownership quickly, for a Sec 8 Company in India, it is easier to leave or transform the ownership of a Section 8 Company

-

Capital Flexibility

Apart from the share capital of the Company, the required funds are present in the form of subscriptions from members, donations, or the general public.

-

Zero Stamp Duty

A Section 8 company does not have to pay stamp duty at the time of registration.

-

Minimum Compliances

Section 8 Company is expected to do less legal formalities than any other company. It gets exclusive rights and privileges under the Companies Act, 2013. Therefore, in Section 8 Company, less number of enforcement is needed.

Checklist

- The company should be created for the charitable or such other purpose only

- The company should not pay any dividend to its members.

- Income and profits should be used for charitable purposes only.

- At least 1 director must be a resident of India, i.e., has been living in India for a duration of more than 182 days in the previous calendar year.

- Whatever amount of initial capital has been allocated for the company, it must be invested in 2 months.

- All the Directors must have their valid DSC (Digital Signature Certificate) and DIN (Director’s Identification Number).

Documents Required For Section 8 Company Registration

Section 8 company registration in India is done with valid identity and address proof. Identification proof and address proof are compulsory for all the directors and the shareholders of the company to be registered. The documents acquired by MCA for the online Section 8 company registration process are given below:

Identity and Address Proof of Shareholders and Directors

- Scanned copy of Voter’s ID/Driver’s License/Passport (Anyone)

- Scanned copy of PAN Card (In case of NRIs and Foreign Nationals, Passport is necessary

- Scanned copy of the telephone or mobile bill/ latest bank statement/gas or electricity bill of the person (Anyone, but not older than two months)

Remember that for the foreign nationals, an apostilled or notarized copy of the passport has to be submitted compulsorily. All documents filed should be accurate and authentic

Registered Office Proof

For online company registration in India, the company should have a registered office in India. The documents that are necessary to be provided while giving Registered Office details:

- Scanned copy of Notarized rental agreement

- Scanned copy of the telephone or mobile bill/ recent bank statement/gas or electricity bill in case you own property

- Scanned copy of No-objection certificate(NOC) from the property owner

Note: Your registered office can be a commercial premise or can be your residence also.

Procedure For Section 8 Company Registration

As the process of registering a Section 8 Company has now become simple, still help from an expert is suggested to complete the several complicated forms and submit them on time. Moreover, the government sites and language are a bit on the tough side, too.

MERALEGAL is an expert in Section 8 company Incorporations, with 8 years of experience in the field and successfully registering the number of Section 8 Companies. Our services are distributed all over India. Steps needed to register a section 8 company are as follows:

-

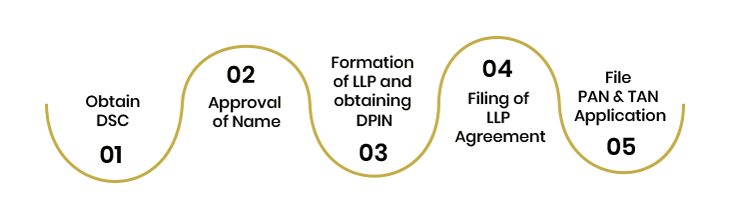

Step 1: Apply for Digital Signature Certificate(DSC)

Since the process is entirely online, therefore all authorized signatories/directors who want to sign the online registration documents need to apply for Digital Signature Certificate.

-

Step 2: Apply for Director Identification Number(DIN)

DIN can be applied with the company registration application form, that is, SPICE -32. But, a maximum of 3 Directors can get DIN together with SPICE 32.

If the user already has a valid DIN, and the particular given has been modified as on application date, and the declaration to this effect is included in the application, identity and address proof need not be attached.

-

Step 3: Apply for Name Approval through RUN

For the approval of the name, an application is filed in the defined Form RUN (Reserve Unique Name) with the Ministry of Corporate Affairs(MCA). Note that at least 2 names at the time of the registration are suggested.

-

Step 4: Submitting Final Incorporation Documents

Earlier, Form INC 12 was used to get a Section 8 license, but now with impact from 7th June 2019, this condition is no longer applicable. So, the process of registration of Section 8 Companies is now as easy as the process of incorporation of other Companies. Section 8 Companies can be registered into the filing SPICe. License no. for a section 8 company will be given at the time of registration itself. Apart from SPICe, the documents that need to be filed are as follows:

- Company’s Articles of association (AOA) & Memorandum of Association (MOA) in the specified form (Form no. INC – 13) where the photographs of subscribers are attached.

- The document is to be attached in Form no. INC-14 (on the stamp paper, duly notarized) by an Advocate, Cost Accountant, a Chartered Accountant, or Company Secretary that the draft memorandum and articles of association have been drafted under the terms of section 8 and rules made herein and all the conditions under section 8 have been followed.

- Evaluation of the company’s annual income and expenditure for the next three years, describing the purpose of the expenditure and the sources of the revenue.

- A statement (in Form no. INC-15) on stamp paper properly notarized by each of the individuals making the application and Form no. INC-9 from all users and first directors.

-

Step 5: Receiving Certificate of Incorporation and License and opening Bank Account

After approval of registration documents, you will get your Certificate of Incorporation, including your Section 8 License, Company Identification Number (CIN), together with the PAN and TAN of your company. After this, you can open a bank account on the name of your company and can start your business.

Annual Compliances for Section 8 Company

Compliances which must be adhered to are as follows:

- Minimum 2 Board Meetings in a year

- Annual returns, with other e-filing forms like MGT-7, AOC-4, etc

- Audit of the Books of Accounts is mandatory.

- Income tax returns.

- Further conditions to fulfill the registration u/s12AA, 80G, of the Income Tax Act, applicable to donations, etc.

How can we assist in getting registration?

Our services include:

- DSC & DIN for subscribers and directors

- Assured name approval from MCA

- Filling e-forms of company incorporation with the MCA

- Regular updates during the incorporation process

- Drafting purpose, Article of Association(AOA) and Memorandum of Association(MOA)

- Business plan guidance

- PAN and TAN

- The legal agreement, corporate draft set, letters on the basis of need.

Frequently Asked Questions ?

Any individual or a group of persons intending to register a company for the purpose defined below can apply for registration of Section 8 Company. To the satisfaction of the Central Government, the following have to be proved:

- Its purpose includes the development of art, commerce, science, education, sports, research, religion, social welfare, charity, protection of environment or any such other thing;

- The company after registration expects to apply its profits, if any, or other income in developing such objects only; and

- The company plans to prevent the payment of any dividend to its members.

Registrars of Companies of corresponding jurisdictions are assigned with the powers of the Central government to issue licenses to Section 8 Companies.

The term “person” is not described under the Companies Act, 2013. Section 2(41) of the General Clauses Act, 1897 specifies that “person” will include any Company, or group or group of individuals, whether incorporated or not. Thus, such a person can be a natural or legal person. A partnership company can also be a member of Section 8 Company.

To form a Section 8 company, at least two directors are needed in which at least one must be an Indian citizen.

Yes. It is compulsory to have a non-profit motive for the organization.

There is no minimum capital needed to form a section 8 company.

For Section 8 Company incorporation, an application will be made to the Registrar of Companies and including the following documents:

- Draft Company’s Articles of association (AOA) & Memorandum of Association (MOA) in the specified form (Form no. INC – 13) where the photographs of subscribers are attached.

- The document is to be attached in Form no. INC-14 (on the stamp paper, properly notarized) by an Advocate, Cost Accountant, a Chartered Accountant, or Company Secretary that the draft memorandum and articles of association have been drafted under the terms of section 8 and rules made herein and all the conditions under section 8 have been followed.

- Evaluation of the company’s annual income and expenditure for the next three years, describing the purpose of the expenditure and the sources of the income.

- A statement (in Form no. INC-15) on stamp paper properly notarized by each of the individuals making the application and Form no. INC-9 from all users and first directors on relevant stamp paper of the State and duly notarized.

No, Companies (Incorporation) Rules, 2014 Rule 3 forbids a one-person company from being registered as a section 8 company or to change into a Section 8 Company.

Yes, section 8 companies can support another company and become a holding company of another company.

Payment of stamp duty is regulated by the Indian Stamp Act, 1899, as enacted by the respective state. Few states provide relaxation for stamp duty payment at the time of registration. However, no relaxation is given by any state on the issue of share certificates.

You can get a section 8 application form on the MERALEGAL website.