LLP Registration

Get Your Company LLP Registration

Quick, Convenient and Secure Online Process.

Free Consultation

Today's Offer

LLP Registration

Direct Call: Mumbai : 9167687835

Direct Call: Pune : 9028055500

LLP Registration

Overview

Limited Liability Partnership Firm (LLP) is a special kind of business entity that is easy to include with a minimum of two partners and requires less post-registration clauses and maintenance as compared to any other type of business. To overcome the possibility of unlimited liability, LLP formation came into the picture. If a start-up is not interested in raising funds and wants less stress on the clauses part, then they can opt for LLP.

LLP is an alternative business channel that offers the benefits of limited liability company and the flexibility of a partnership firm. Since LLP includes aspects of both ‘a corporate structure’ and ‘partnership firm structure,’ it is sometimes referred to as a mixture of a company and a partnership. LLP is a different legal entity that can maintain its presence regardless of changes in its partners. LLP is an organized partnership established and registered under the Limited Liability Partnership Act, 2008.

Since its launching in 2010, LLPs have been well supported with more than one lakh registrations in India. LLP is beneficial and suitable for the following:

- Small and Medium Enterprises

- Company Secretaries

- Chartered Accountants

- Cost Accountants

- Advocates

Why Choose MeraLegal?

- India’s first award-winning service provider with minimal fees

- We provide a free consultation, followed by subsequent meetings.

- On-time updates and real time status tracking

- We help in obtaining DSC for all partners.

- Complete guide on opening a Bank Current Account

- Strong Team of Lawyers, CA, CS, etc.

- Less time in forming LLP

- 24*7 Customer support

What Includes in Package?

- Free consultation till your Every Doubt is solved

- Current Account Opening Assistance

- DSC, PAN, DIN, TAN, Inc

- Timely Updates on ROC compliances

Advantages

-

Separate Legal Entity

An LLP is a distinct legal entity, just like companies. It follows the principle of constant succession. The entry and exit of a new or current partner do not dissolve its existence. Moreover, the assets of the business are not operated by any of the partners.

-

Limited Liability

Each partner's liabilities are restricted to the capital made by the partner. It means that if the company suffers any losses, then the personal assets of the company’s partners won’t be grabbed. Also, they would not be needed to pay for those losses.

-

No requirement of Minimum Capital Contribution

To start an LLP, you don’t have to maintain any minimum capital criteria. You can begin your LLP with just as low as one rupee. Therefore, the cost of forming an LLP is minimal.

-

Less Compliance

Some clauses and rules are in comparison to any other type of an entity like a private or Public Company.

-

Easy transfer of ownership

In an LLP, it’s very simple to transfer ownership to others. Unlike the traditional partnership firm where the joining of new partners affects its presence, in an LLP, things are quite the opposite.

-

No Requirement of Audit

In LLP, there is no necessity for conducting the audit. The need for audit occurs only in the following two situations:

When the annual turnover of the business reaches the limit of Rs. 40 lakhs, or

When the capital investment reaches above Rs. 25 lakhs. -

Integration of Multiple Taxes

Currently, goods and services are taxed under many VAT registrations that exist in different forms, across many states in India. Each state has a specific VAT rate & regulations, etc. Apart from the VAT and sales tax, there are others that businesses will adhere to CST, luxury tax, purchase tax, etc. Under the GST system, all these taxes will come under one umbrella and be molded into one single tax.

Checklist

Following are the essential checklist to form LLP Firm:

Minimum 2 designated Partners

Partners are those who own and operate the LLP. On the other hand, according to the Act, designated partners are responsible for the compliance part. The minimum number of partners to form an LLP is two. So, among the partners,

- There should be an at least of two appointed partners who shall be individuals, and

- At least one of the partners should be an Indian resident.

-

Maximum Limit of Partners

There is no upper limit to the maximum number of partners at LLP. Hence, there can be many partners.

-

PAN for all the partners

It is necessary to remember that all the partners must have a PAN compulsorily.

-

DPIN for all the partners

All nominated partners should have a DPIN (Designated Partners Identification Number). In a situation when a person is becoming a partner in an LLP for the first time, he will get DPIN once the LLP is integrated.

-

Digital Signature Certificate (DSC) for one Designated Partner

Every proposed partner must need a DSC to digitally sign the e-forms for the establishment of an LLP. In a scenario, if you do not have a DSC, you can apply for it through MeraLegal at a lower cost.

-

Registered Office

LLP should have an address for its Registered Office. It can be a commercial area or a residential one. Moreover, it can be rented or owned one.

Documents Required

The list of documents which are required for registration from partners and LLP are :

Documents of Partners:

-

Copy of PAN Card

All the partners are expected to make their PAN available at the time of registering LLP. A PAN card serves as the main ID proof.

-

Passport size Photograph:

Partners should also give their passport size photograph, preferably on white background.

-

Copy of Voter ID/Driving License:

Partner can file any one document out of Driver’s license or Voter’s ID

-

Latest Bank Statements/Mobile or Telephone Bill (not older than two months):

These documents serve as the partners residence proof and must contain the partners name.

-

Passport (in case of Foreign Nationals/ NRIs):

To become a partner in Indian LLP, NRIs and foreign nationals must give their passport mandatorily. Passport has to be validated or authenticated by the relevant authorities in the country of such NRI and foreign nationals,, otherwise, the Indian Embassy of that country can also sign the documents. Foreign Nationals or NRIs have to give a proof of address also which will be a residence card, driving license, bank statement, or any government-issued identity proof with the address.

Note: If the documents are in other languages, rather than the English then, a validated or authenticated translation copy will also need to be added. -

Consent of Designated Partners in Form 9:

Form 9 is signed by the designated partners giving their permission for becoming partners in the existing LLP.

Documents of LLP:

- NOC and Rent Agreement if the premise is rented.

- Address proof of Registered Office such as Electricity Bill etc.

In addition to the above documents, a subscriber sheet requires to be signed by the designated partners, which must be approved by a professional practicing agent.

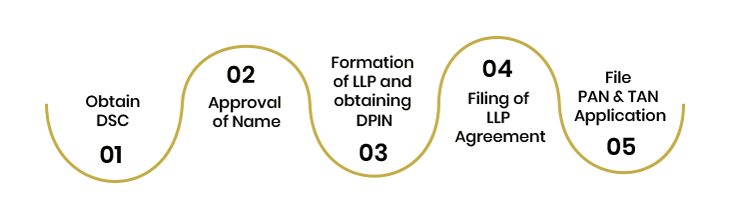

Registration Process

-

Step 1: Obtain Digital Signature Certificate (DSC)

Before starting the registration process, you need to apply for the digital signature of the designated partners of the proposed LLP. This is because all the documents like ROC compliance forms, LLP Registration Forms, and Tax Returns for LLP are filed online and need to be digitally signed.

Hence, the designated partner must get their digital signature certificates before filing e-forms for registration and any other online purpose. You can contact us to get a DSC at a very low cost.

-

Step 2: Apply for Reservation of Name

Limited Liability Partnership-Reserve Unique Name (LLP- RUN) is filed for the reservation of the name of suggested LLP by giving a different name. The name must not be identical to the name already in use. The registrar will approve the Company name only if the name is not objectionable in the view of the Central Government and does not match with any current partnership firm or an LLP or a corporate entity or a trademark. The RUN-LLP form must be bought by fees which can be either rejected/approved by the Registrar. A resubmission of the form shall be provided within 15 days for correcting the mistakes. There is a provision to give two proposed names of the LLP.

-

Step 3: Incorporation/Formation of LLP

- For incorporation, the form used is FiLLiP(Form for incorporation of Limited Liability Partnership), which will be registered with the Registrar who has authority over the state where the LLP’s registered office is located. The form will be an integrated form.

- This form also allows for applying DPIN allotment if there is no DPIN or DIN for a person who is to be selected as a designated partner.

- The request for allotment will be permitted to be made by only two individuals.

- The reservation application can be made via FiLLiP too.

- When the name that is applied for is approved, then this reserved and approved name shall be registered as the LLP’s proposed name.

- When the Registrar approves the proposed LLP, it will provide an incorporation Certificate in digital form. Please note that currently, no physical certificate is released by the Registrar.

-

Step 4: File Limited Liability Partnership Agreement

- LLP agreement regulates the mutual rights and duties between the partners and also among the LLP and its partners.

- LLP agreement must be registered online in form 3 on the Ministry of Corporate Affairs (MCA) portal.

- For the LLP agreement, it is compulsory that Form 3 must be filed within 30 days of the incorporation date. Otherwise, there will be fines for non-filing.

- It is necessary to print the LLP Agreement on Stamp Paper. For every state, the Stamp Paper value is different.

-

Step 5: File PAN and TAN Application

When the LLP registration procedure is completed, the applicants need to submit the PAN and TAN Application online/offline on the NSDL portal for the newly registered LLP after giving all the information and essential documents.

Important Forms in LLP Registration

Have a quick look at the important forms used for LLP:

-

RUN-LLP (Reserve Unique Name – Limited Liability Partnership)

This form is used for registering a name for the LLP.

-

FiLLiP

This is a main form used for starting LLP incorporation.

-

Form 5

It is used to give notification for a name change.

-

Form 17

Application and description for the reformation of a firm into LLP

-

Form 18

Application and statement for changing into LLP from a private or unlisted public company.

Frequently Asked Questions ?

LLP registration fees are based upon several factors and vary from case to case. MeraLegal offers the lowest rates in the market for LLP company registration.

Please refer to the above mentioned step-by-step process for online company registration.

Benefits of LLP form of a business are:

- It is built and works on the basis of an agreement.

- It provides versatility without enforcing specific legal and procedural conditions.

- It allows professional/technical expertise and efforts to merge with financial risk-taking ability innovatively and effectively.

The LLP framework is available in many countries like the United Kingdom, Australia, the United States of America, various Gulf countries, and Singapore. The LLP Act is majorly based on the UK LLP Act , 2000 and Singapore LLP Act 2005, on the view of experts who have studied LLP legislations in many countries. Each of these Acts offers the creation of LLPs in a corporate body form, i.e., as a separate legal body separate from its partners/members.

- The difference between an LLP and a joint-stock company resides in the internal governance framework of a company is regulated by the Companies Act, 2013, while for an LLP, it will be governed by a contractual agreement between partners.

- The features of the management-ownership divide in a company are not there is a limited liability partnership.

- LLP has more adjustability as compared to a company.

LLP has fewer compliance conditions than a company.

There must be a minimum of two individuals to be selected as Designated Partners, and among them, one must be an Indian resident. Also, in India, a business address should be available to register as a registered office for LLP

LLP Agreement explains the internal constitution of the partnership, vision, overall mission, business goals of the organization firm in the long run.

You need to register it within 30 days of the LLP incorporation

Yes, if one fails to file the LLP Agreement within 30 days of the LLP formation, a heavy fine is imposed, i.e., Rs.100 per day by default with no limit on the maximum penalty.

MeraLegal is India’s only premium service provider, which helps to register an LLP within 7-10 working days.

According to the provision of the LLP Act, 2008, designated partners are liable for all the LLP compliances and such related matters.

Any number of people can be selected as a partner, but a minimum of two people must be selected as a designated partner. Designated partners are responsible for doing all the important actions and ensures that all the laws are adhered to, and agreements are completed on time. In case of any error, such designated partners are liable to pay off fines imposed on LLPs.

Whatever LLP partners contribute to run the business is referred to as a contribution. Contribution can be in the type of any of the following

- Cash

- Agreements

- Promissory notes

- Movable or immovable property etc

- Intangible/tangible asset

LLP Annual filing contains the following item: Accounts Annual Return Statement, or you can say LLP Income Tax Returns Filings Financial Statements.