GST Returns

Apply Online For GST Returns

Quick, Convenient and Secure Online Process.

Free Consultation

Today's Offer

Online GST Filing

Direct Call: Mumbai : 9167687835

Direct Call: Pune : 9028055500

Important Points

- Cost-effective fees across India.

- Compulsory for everyone who has taken GST Registration.

- Arrange all receipts with Proper Accounting.

- Regular Filing of all Purchase, Sale GST Returns.

- Fee Rs. 1999/- Per Month/More than 50 Invoices in a Month

- Work managed by Professionals.

About GST Return Filing

Overview

GST is a consumption-based tax and a comprehensive indirect tax which shall impose on the supply of goods and services. This taxation system is expected to make one taxation system within the entire country for all products and services. This would be the largest tax after independence and a blessing to the economy as it will eliminate the deficiencies of the current tax structure and provide a single tax on the supply of all goods and services.

A GST file return is filed with the GST department, including the details of purchases, sales, and tax paid and collected, and all the other details needed under the law. Further, GST return filing would be compulsory for everyone registered under the GST Act regardless of the fact whether there was any sale or any other activity made during the period; otherwise, late fees of INR 2000/- per month would be imposed.

GST returns are records that are filed with the GST department stating every detail which is needed under the law. Moreover, every registered person needs to file GST return online and which is suggested through software. If your turnover exceeds 20 lakh, then you need to get registered, and file 3 monthly GST returns.

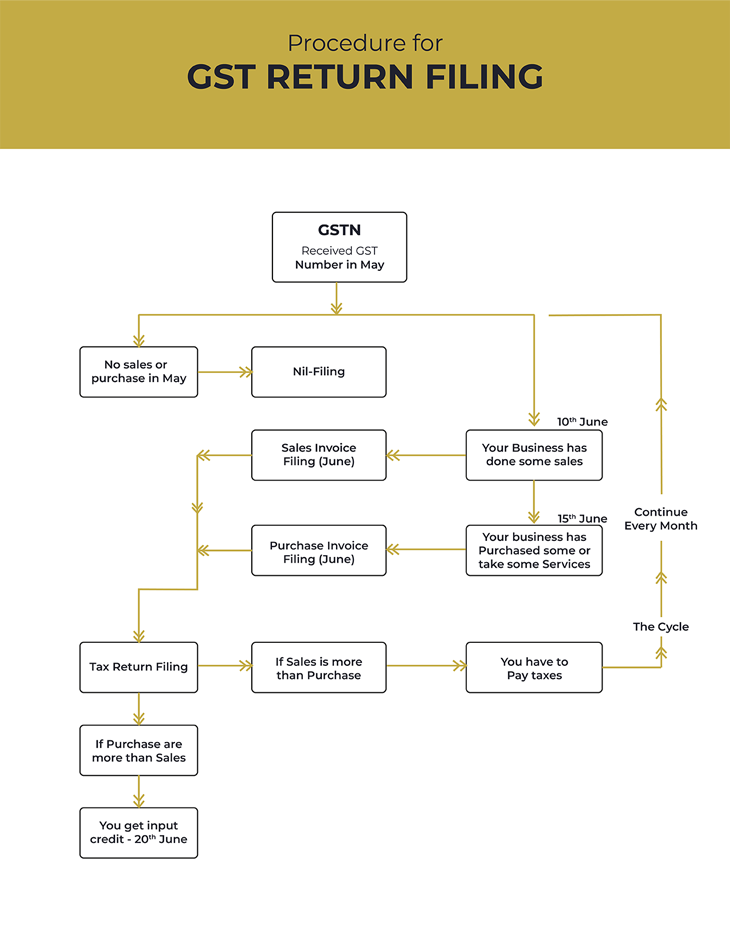

Process For GST Return Filling Services Online

GST Return filing Process

- Step- 1 Submit GSTR -1

(First step is to file GSTR – 1 which your buyer can see in GSTR – 2) - Step- 2 Get Buyers Approval

(Your buyer shall approve, modify details which you can see in GSTR 1A.) - Step- 3 Monthly Return

(Once details are approved, then you should file GSTR – 3.)

Types of GST Return and Due Dates

There are many returns to be filed under GST law. Most popular are GSTR 1, GSTR 2 and GSTR 3, because they need to file them monthly.

| Types | Details about GST Return | By When? | By Whom? |

|---|---|---|---|

| GSTR- 1 | Outward return (Details about your sales/ Supplies made during month) | 10th of next month | Registered person except few |

| GSTR- 2 | Inward return (Details about your purchases made during month) | 15th of next month | Registered person except few |

| GSTR- 3 | Month return (for cumulative records of inward and outward made during month) | 20th of next month | Registered person except few |

| GSTR- 4 | A return by Composite dealer (a person availing such service with supplies < 50 lakh) | 18th of next month | Composite dealer only |

| GSTR- 5 | Monthly return by Non resident taxable person | 13th of next month | Registered non resident |

| GSTR- 6 | Monthly return by input service distributor | 13th of next month | Input service distributor |

| GSTR- 7 | Person who are required to deduct TDS | 10th of next month | Prescribed persons |

| GSTR- 8 | E-commerce market places who are required to deduct TDS | 18th of next month | Registered person except few |

| GSTR- 9 | Annual Return | 31th of next year | Every Registered Person |

Advantages of GST Return Filing

-

Bring Improvement

Currently, all businesses, whether goods or services, must comply with various Statewide VAT and service tax regulations, which only adds to the complexity of the whole process of running a business. With the introduction of GST, the gap between goods and services will vanish.

-

Lower Taxes

Currently, in some states, businesses are required to comply with VAT regulations once they reach an annual turnover of Rs.5 lakhs. Under the GST system, GST liability increases only if an entity exceeds an annual turnover of Rs.10 lakhs in the North-East or hill states, whereas, for the rest of India, the limit is set at Rs. 20 lakhs.

-

GST Exemption for Startups and Small Businesses

Earlier businesses exceeding an annual turnover of Rs 5 lakh (Rs 10 lakh in some states) must have VAT registration and to pay VAT as a requirement. This multiple VAT regulation across states is expected to be confusing. However, when GST comes into the picture, the complexity will not exist, and once implemented, businesses with a supply turnover below Rs. 20 lakh will not need to register for GST or even collect it.

-

Integration of Multiple Taxes

Currently, goods and services are taxed under many VAT registrations that exist in different forms, across many states in India. Each state has a specific VAT rate & regulations, etc. Apart from the VAT and sales tax, there are others that businesses will adhere to CST, luxury tax, purchase tax, etc. Under the GST system, all these taxes will come under one umbrella and be molded into one single tax.

Frequently Asked Questions ?

MeraLegal can help in preparing GST filing statements in much less time and at a reasonable price.

- Each registered person is expected to file GSTR-1 by the 10th day of the following month, which can be seen by the purchaser in GSTR-2A

- After the buyer’s permission and submission in Form GSTR-2 by the 15th of the following month, suppliers can alter the information in GSTR 1A.

- Finally, GSTR-3 return will be available for processing along with the Invoice by the 20th of the subsequent month.

Tax paid by the regular taxpayer is to be done monthly and it should be done by the 20th of the subsequent month. Cash will be first deposited in the Cash Ledger, and the taxpayer shall debit the ledger before making payment in the monthly returns and shall reflect the appropriate debit entry number in his return. For Example-Tax Payment for March shall be paid by the 20th of April.

In such situations, the return is not counted as a valid return.

Under the GST Act, a regular taxpayer will be expected to provide 3 monthly returns and one annual return. Likewise, there are various forms of returns that a taxpayer registered under the composition scheme and as an Input Service Distributor.

Documents required for Public Company (limited company)/Private Limited Company (Pvt Ltd)/Limited Liability Partnerships (LLP)/One person company (OPC):

- PAN card and Registration Certificate of the Company/LLP.

- Copy of Bank Statement

- Memorandum and Articles of Association in case of Company and LLP agreement in case of LLP.

- Declaration to comply with provisions and copy of Board Resolution.

- Registered Office Documents (Copy of Electricity bill or Water bill, No objection certificate from the owner, Rent agreement if premises are rented)

- PAN and ID proofs of the Directors/Designated Partners.

Documents required for Sole proprietorship/Individual:

- PAN Card and ID proof of Individual.

- Declaration to comply with provisions.

- Copy of Cancelled Cheque or Bank Statement.

- Registered Office Documents ((Copy of Electricity bill or Water bill, No objection certificate from the owner, Rent agreement if premises are rented).

Information required(only information, No documents required)

- Login ID and Password (if generated earlier)

- Name of the proposed unit

- Email ID and phone number of Director/partner/Individual.

- Objects of business for which registration is required.

- Any other information as may be required.

A person can check the registration status on the website directly.

Every registered taxable person who exceeds the threshold limit for payment of taxes needs to file the return in a GST system.