Professional Tax Registration

Apply for Professional Tax Registration

Quick, Convenient and Secure Online Process.

Free Consultation

Today's Offer

Professional Tax Registration

Direct Call: Mumbai : 9167687835

Direct Call: Pune : 9028055500

Professional Tax Registration in India

Overview

In India, a tax imposed on trades and professions is known as professional tax. It is mandatory for each member of the staff hired by a private company to pay this state-level tax. The private company's employer must deduct professional tax from the employee's pay cheques and submit the amount collected thereafter to the concerned government department. MERALEGAL can assist you in filing professional tax. Professional tax is typically a slab based amount which is deducted from the professional's gross income.It gets deducted from a person’s monthly income.Maharashtra, West Bengal, Karnataka, Andhra Pradesh, Maharashtra, Tamil Nadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya,Orissa, Tripura, and Madhya Pradesh. The business employer is liable to deduct professional tax with the State Government when it comes to contract staff and salaried employees. For other classes of persons, payment of this tax is the legal responsibility of the person himself.The professional team of MERALEGAL is there to help you get professional tax registration in India at the best prices in the market.

Process for Professional Tax Registration

Professional Tax Rate

INR 2,500 is the highest amount that can be paid yearly towards professional tax. Professional tax is typically a slab based amount which is deducted from the professional's gross income. It is deducted from a person’s monthly income. The tax rate is varied from state to state as stated below:

Exemption from Professional tax

The individuals referred to below are exempted to pay professional tax

- Parents of children with physical or mental disabilities.

- Members of the defense forces, including members of supplementary forces who are serving

- People above 65 years of age.

- Individuals are physically or visually impaired.

- Women entirely occupied as representatives under the Mahila Pradhan KshetriyaBachat Yojana or Director of Small Savings.

- Badli workers in the textile industry.

- Parents or guardians of persons who are mentally challenged

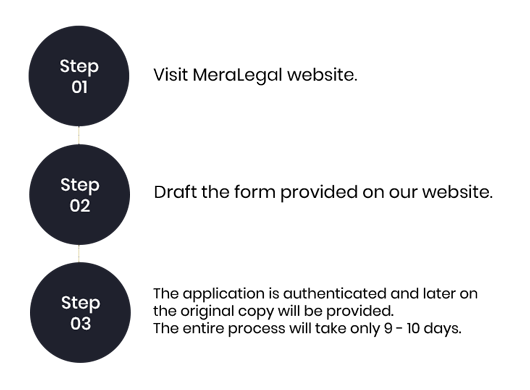

Professional Tax Registration Process in India

The professional tax registration procedure is not very tedious.There are three important points which need to be taken into account:

-

Professional tax varies from one state to another state

In case an employer has employees working in multiple states, then professional tax registration for all the states have to be taken. The tax slab rates can differ from one state to another, as shown above. For small-scale industries, this can be a tiresome process. This is a reason why many states in north India do not have professional taxes.

-

Filing of Returns

Frequency of filing returns under professional tax varies from one state to another. Therefore rules of the state must be well versed before applying for a return

-

Penalties

If there is a delay in tax payment, penalties are levied, which are different from one state to another.

Steps involved in Online Professional Tax Registration

- Submit PAN card, proofs of identity and address proofs of all the partners/directors /proprietors of the firm on day one. Give info of all the employees; you work with.

- Once the above info furnished, employees will have to fill up and submit the application form for the professional tax to the concerned department. This process will not take more than 2 working days, provided all documentation is in sequence.

- Acknowledgment of submission of application will be received in 5-7 days of time. The inspector will demand the missing documents if required. As soon as missing documents are submitted, the process will be finished. It will take 10 working days for registration hard copy to be issued, and it can take up to 15-20 days for the same in B cities.

Documents required for Professional Tax Registration

- Certificate of Incorporation, MOA & AOA / LLP Agreement.

- PAN card of Company/LLP, which is duly attested by the director of the company.

- Address proof of business along with a NOC from the owner of the property.

- The bank account of the company, bank statement, and one canceled cheque.

- Passport size photographs, address, and identity proof of all the directors.

- Statement of consent by partners.

- Attendance and salary register.

- Shop and Establishment certificate.

Importance of Professional Tax Registration

-

It is a Legal requirement

Employers in certain states are expected to obtain professional tax registration, and they must deduct and pay service tax on behalf of employees.

-

It is important to avoid penalty

Fines and penalties would increase over time if there is a failure to get professional tax registration.

-

Deductible Tax

A deduction made from salary can be claimed only if professional tax registration has been completed. The deduction for professional tax will be approved for the year in which the employee pays the tax.

-

Professional tax is an easy compliance

Compliance with professional tax regulations is not so complex. Professional tax registration can be acquired quickly, and compliance can be handled easily.

-

State Government Tax

State Governments and Local bodies are authorized to collect professional taxes from professionals, trades, and employment. The upper limit on the amount of professional tax collected is Rs.2500 per annum.

Frequently Asked Questions ?

It is a revenue income for the state government, which allows the government to implement development and welfare work in the state. The income tax deduction is given on tax paid as a professional tax.

The highest amount of professional tax on a person is Rs. 2,500 annually and the amount is forwarded to the respective State Government. The total amount of professional tax paid in a year be acceptable for deduction according to the Income Tax Act, 1961

The stipend is paid to those who are working to seek some knowledge; hence the stipend is not subjected to professional tax.