GST Registration

Register Your business for GST

Quick, Convenient and Secure Online Process.

Free Consultation

Today's Offer

GST Registration

Direct Call: Mumbai : 9167687835

Direct Call: Pune : 9028055500

GST Registration

Overview

GST or Goods and Services Tax was implemented by the Indian Government to control the prices throughout the country and eliminate all state or central Government applied indirect taxes on goods and services by implementing GST registration in India. According to the recently revised notification in 2019, businesses whose turnover is above Rs.40 lakhs (Rs. 20 lakhs for hill states and North East) are expected to get their GST as a normal taxable person and hence need to apply for GST Registration compulsory. Apart from the above turnover category, there are many situations where GST registration is mandatory for those persons or organizations who are involved in the supply of goods or services all over the state.

You may apply for online GST Registration either under the GST composition scheme or as a normal taxpayer. Taxpayers with below Rs.1.5 crore turnover can apply for a composition scheme to get relieved of repetitive GST formalities and pay GST at a fixed rate of turnover. The procedure for GST is fully online and needs no manual intervention. Once the registration is completed under GST, you will receive a unique GSTIN (Goods and Service Tax Identification Number). After the registration is completed, the Central Government issues a state-wise, 15-digit number to you. There are many advantages of GST registration, such as you will get a legal identity as a supplier. Moreover, you can also get an input tax credit and collect GST from the final receivers of goods and services.

The registration process for GST in India is straightforward. You fill the form on GST online portal to register under GST with the help of our Expert.MeraLegal provides you the cheapest price for GST registration to apply for GST number online. Bookkeeping & Accounts Records are easy to maintain under GST norms.GST registration online procedure is straightforward and can be quickly done by visiting Online GST portal. Our Team will help you with Quickest Online GST registration. There are many GST slabs in India, and if you are trading in various GST Slab goods. GST Calculator Online assists you to get either gross or net profit on GST rates. You can easily apply for multiple states and Central Government tenders if you have GSTN.

Who Needs GST Registration Number?

- If the business has prior registration under VAT, Excise Laws, Service Tax Laws

- Any business whose turnover is above Rs. 40 Lakh and Rs. 20 Lakh (In the case of Jammu and Kashmir, North-Eastern States, Himachal Pradesh, and Uttarakhand).

- If the business is trading in more than one state

- People who pay taxes under Reverse Charge Mechanism.

- If you are providing goods and services outside India.

- You are selling your goods or services online (e.g., selling on Flipkart and Amazon).

Various GST Tax Rates

- Exempt – Basic Necesseties

- 5% – Household Necessities and Life Saving Drugs etc.

- 12% – Computers and Processed Food

- 18% – Hair Oil, Toothpastes, soaps, capital goods, industrial intermediaries and services

- 28% – Luxury Items

Our online GST calculator helps you to measure SGST, CGST, IGST tax amount quickly.

Benefits of GST Registration

GST gives advantages to the industry, the citizens of India, as well as the government. Some of the advantages of GST Registration are:

- You can legally collect taxes from consumers and pass the Tax Benefits on to suppliers.

- Your business Matures 100% Tax Compliant.

- You can Claim Input Tax Credit you paid on your purchases and increase profits.

- While opening any kind of Business Account or a current account, a GST certificate can be used as one of the documents.

- Extend your business through multiple channels such as online, Export-import.

- You can easily apply for multiple states and Central Government tenders if you have GSTN.

- To start service of payment gateways and mobile wallets, the GST number is used.

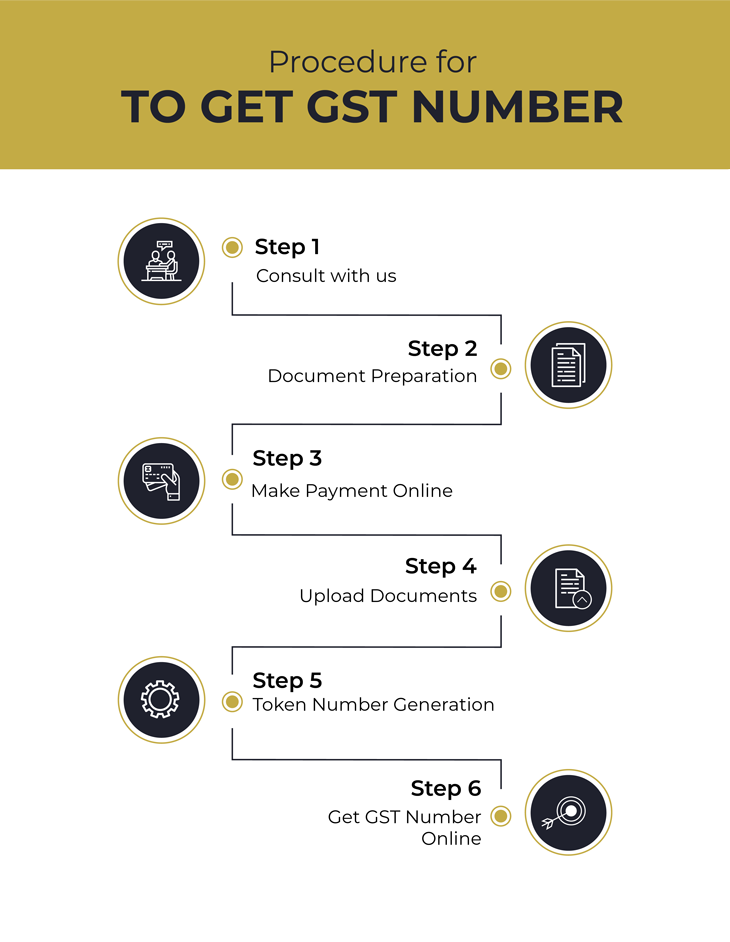

How Can We Help in Getting GST Number ?

Documents Required For GST Registration

Following is the list of documents which are needed for registration of GST for many businesses:

For Proprietorship

- Address proof and PAN Card of the proprietor

For LLP

- LLP Agreement

- PAN Card of LLP

- Partners’ names and address proof

For Pvt. Ltd.

- PAN Card of Company

- Certificate of Incorporation

- Memorandum of Association, MOA

- Resolution signed by board members

- Articles of Association, AOA

- Digital Signature

- Identity and address proof of directors

Proof of A Director

- Passport

- Aadhar Card

- PAN Card

- Ration Card

- Voter Identity Card

- Driving License

- Telephone or Electricity Bill

- Bank Account Statement

Frequently Asked Questions ?

GST(Goods and Service Tax) is one type of indirect tax imposed in India on the supply of goods and services. According to the GST laws, it is essential to apply for GST registration when a business comes under specific criteria. Online GST registration can be done quickly with the help of MeraLegal experts.

Registration under Goods and Services Tax (GST) administration will give the following benefits to a business:

- Officially recognized as a supplier of goods or services.

- Proper accounting of taxes collected on the input goods or services that can be used to pay GST due to the supply of goods or services by the business.

- Pass on the credit of the taxes paid on the goods and services supplied to purchasers or receivers.

- Authorization to an individual to collect tax on behalf of the Government.

Under the GST Act & Regulation, GST registration is mandatory if your total annual PAN based turnover exceeds INR 20,00,000 (Rupees Twenty Lakhs).

However, the criteria for registration are INR 10,00,000 (Rupees Ten Lakhs) if you have a place of business in Himachal Pradesh, Arunachal Pradesh, Manipur, Assam, Jammu & Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Tripura

Regardless of your turnover, registration is compulsory if

- You supply goods through an E-commerce portal

- You make Inter-State Supplies

- You are a/an Service Provider.

- TDS/TCS Deductor.

- Agent for Registered Principal

- Casual Taxable Person

- Liable to Pay Reverse Charge

- An online data access and retrieval service provider

- Non-resident Taxable Person

- Input Service Distributor

- E-commerce Operator.

No, because the new registration is entirely Online.

Before you apply for a GST Registration as a normal taxpayer, it is compulsory to get a PAN except for TDS registration, which is possible via TAN.

You will sign your application using the Aadhaar-based ESign facility or a Digital Signature Certificate (DSC). Please note DSC is compulsory for

- Private Limited Company,

- Public Limited Company,

- Public Sector Undertaking

- Foreign Company

- LLP

- Unlimited Company

- Foreign LLP

No, every person who is opting for a GST Registration will have to get registered separatelyEvery person who opts for a GST Registration must be registered separately for each of the States where he has a business operation set up and is liable to pay GST under Section 22(1) of the CGST/SGST Act.

No, An individual can neither collect GST from his customers without registration nor claim any GST input tax credit that he has paid.

Small businesses with the turnover below Rs 1 crore (Rs 75lakhs for NE states) can opt for a composition scheme. In GST Registration, the composition dealer needs to pay nominal taxes depending on the nature of the business.

- Composition dealers are expected to file only one quarterly return instead of 3 filed by normal taxpayers.

- They cannot issue taxable invoices, which means they collect tax from customers and are expected to pay the tax from their pockets.

- Businesses who chose the composition scheme cannot ask for Input Tax Credit.

The following are excluded under GST.

- Supply agriculture produce form cultivation

- Supplies come under the Reverse charge

- Exempt supplies or Zero-rated supply or Non- Taxable Supplies of goods or services.

The following penalties involved under GST Act.

- Not having GST Registration: Rs 10,000 or 100% tax Due. Whichever is higher

- Not giving GST invoice: Rs 10,000 or 100% tax due. Whichever is higher

- Incorrect Invoicing: Rs 25,000

- Not filing GST Tax Returns: Regular Return Rs 50 Per Day, For Nil, Return its Rs 20 Per Day.

- Choosing Composition Scheme even if not eligible: Rs 10,000 or 100% tax due. Whichever is higher